HCHD Intends to Keep Current Tax Rate

By Will Johnson

Messenger Reporter

HOUSTON COUNTY – Despite some impassioned talking points, the Houston County Hospital District Board of Directors voted to keep the Fiscal Year (FY) 2020 tax rate at the same rate of 0.149405 per $100 of property valuation as it had in FY 2019.

Before any discussion on the tax rate began, board member Dina Pipes made a motion to “… use the effective tax rate – which is 0.136623 (per $100 of property valuation) – as our tax rate for 2019 (actually FY 2020).”

According to Section 26.16 of the Texas Property Tax Code, “The effective tax rate is the rate that would generate the same amount of revenue in the current tax year as was generated by a taxing unit’s adopted tax rate in the preceding tax year from property that is taxable in both the current tax year and the preceding tax year.”

The motion was seconded by board member Rhonda Brown.

HCHD Board President Barbara Crowson sought clarification on the matter and asked if Pipes meant to keep the same rate as the previous year.

“No,” Pipes replied. “My intent is to go to the effective rate. Our current tax rate is 0.149405. The effective tax rate is 0.136623. That’s what I say we go to. That is what our intent should be.”

“Even though you’re aware our appraisals are likely to be up?” Crowson asked.

“We are going to get basically the same amount of money we got last year,” Pipes said.

“Being the appraisals were up, people are going to pay more money and they’re going to have as much money or more, maybe, then they had before because the appraisals are up for everybody. I shouldn’t say everybody, but the majority of the appraisals are up,” Brown said.

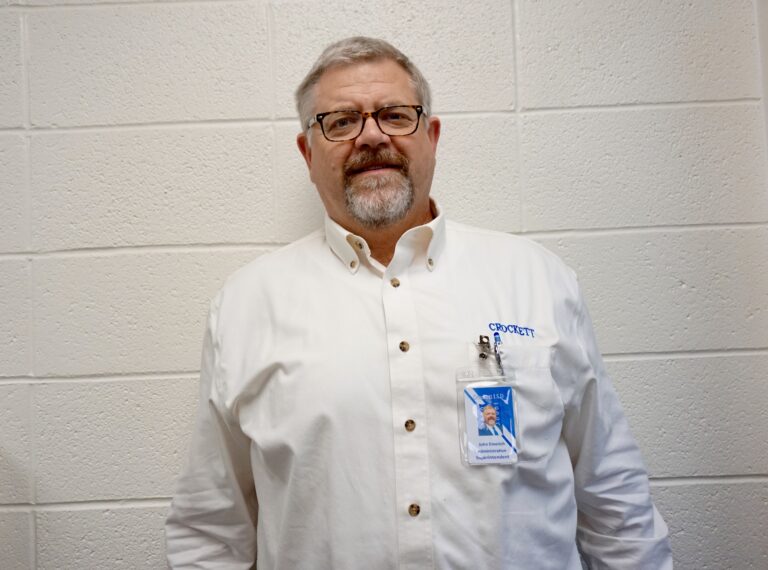

Crowson asked if anyone had any more comments before putting the motion to a vote and Board VP Dr. John Stovall said he did.

“That will cost us a little over $152,000 to do what you’re suggesting. If we leave the rate the same, we will collect another $152,000 and some change. That is something to consider. I understand that people’s valuations are going up but our expenses are going up, too,” he said.

Brown replied, “The forgiveness of the loans and the forgiveness of the CHRISTUS thing has benefitted us in a great way. I don’t think the people in the community – the ones I have talked to – they do not want to see their taxes go up.”

“Our effective tax rate is less than what it was,” Brown added. “I think we need to leave it at the effective tax rate.”

Board member Carol Dawson commented, “We still owe $3 million to Prosperity Bank.”

“Carol,” Pipes said, “I want to read something to y’all. You ran your ad – the five of you who ran last time – and in your ad it said, ‘We are not proposing future tax increases. The tax rate is capped by law and voters have rejected raising it. With the forgiveness of the $4 million debt, the HCHD is in much better financial condition and a tax increase is not needed.”

Pipes went on to explain if the taxes were left at the current tax rate, taxpayers would actually pay more in taxes because of the increase in property valuations. If the rate was moved to the effective rate, taxpayers would pay approximately the same in taxes as they did in FY 2019.

“It’s a matter of semantics,” Stovall said. “We’re not talking about raising the tax rate. That’s what we ran on.”

“That didn’t say the tax rate,” Pipes replied. “It said a tax increase.”

“That’s what I said,” Stovall shot back. “It’s semantics. It’s how you interpret that phrase.”

Brown added, “According to the tax assessor, the effective rate is the 0.136623. We won’t have to do any hearings, no paperwork, no newspaper ads or anything else. We can just move forward and have one meeting.”

Following a moment of cross talk, Crowson spoke up and said, “You have to remember, the debt we owe to the Texas Higher Education Commission is $203,000. Yes, we are doing everything we can to negotiate a better deal. And we have had a little bit of a reason to be somewhat optimistic. But, on any day, we could get a demand letter. That is scary. My goal is for us to operate in the black.”

The board president further indicated the county was seeking payment from the HCHD for “… jail inmates who require indigent care and that number is exorbitant. We are working to see what we need to do or have to do. We have never paid that but they are requesting it, or in a sense, demanding it. Couple that with the situation we recently had on this campus with the air conditioning and I’m reluctant to do anything to lower the amount of money we have coming in. I’m like anyone else, I don’t want to pay any more taxes, but I needed to say that.”

After the tax rate discussion veered off course for approximately five minutes, Crowson managed to steer the directors back to the matter at hand and called for a vote on the tax rate.

The measure to move the tax rate to the effective rate of 0.136623 per $100 of property value failed by a vote of three in favor, four against and one abstention. Brown, Pipes and Harvey Bruner voted in favor of using the effective rate while Crowson, Dawson, Stovall and Pat Dickey voted against the measure. Karen Duncan abstained from the vote citing a lack of information.

Another motion to keep the tax rate at the current rate of 0.149405 per $100 of property valuation was put forth by Stovall.

“I will re-iterate, if we get in a little bit better financial shape, I would certainly not be against lowering the rate. Not just to the effective rate, but actually lowering the rate, if possible,” Stovall added.

Before the vote was taken, Crowson explained, “Does everyone understand this is just a vote on our intent? We will actually set the tax rate – we must do it before Sept. 11.”

The measure to keep the tax rate at the current rate of 0.149405 per $100 of property value passed by a vote of four in favor, three against and one abstention. Crowson, Dawson, Dickey and Stovall voted in favor of keeping the current tax rate while Brown, Bruner and Pipes voted against the measure. Duncan abstained from the vote once again, citing a lack of information. Board member Erin Ford was not present at the meeting.

Will Johnson may be contacted via e-mail at [email protected].